Southland Credit has become a household name for individuals seeking innovative financial solutions in today's fast-paced world. Whether you're looking to consolidate debt, invest in property, or simply manage your finances more effectively, Southland Credit offers a wide range of services tailored to meet your needs. With a reputation built on trust and reliability, they’ve become a go-to choice for many. But what exactly makes Southland Credit stand out? Let's dive in and find out.

Financial stability is something everyone strives for, but the journey isn't always easy. That's where Southland Credit comes in. They’re not just another financial institution; they're your partner in navigating the complex world of credit and loans. From personalized loan options to expert financial advice, Southland Credit ensures you're always in control of your financial future.

Now, before we jump into the nitty-gritty of what Southland Credit offers, let’s take a moment to understand why this company has become such a big deal. In a world where financial institutions often feel impersonal and out of touch, Southland Credit stands out by prioritizing customer satisfaction and building long-term relationships. So, if you're curious about how they can help you achieve your financial goals, keep reading. You’re in for a treat!

Read also:Exploring The Life And Achievements Of Charlie Hodsonprior A Journey Into Success

What Is Southland Credit All About?

Southland Credit isn't just about offering loans; it’s about empowering individuals to take charge of their financial lives. Established with the vision of providing accessible and fair financial services, Southland Credit has grown into a powerhouse in the credit industry. Their mission is simple yet powerful: to help people achieve their dreams by offering flexible and transparent financial solutions.

One of the key aspects that set Southland Credit apart is their commitment to customer service. They understand that every individual’s financial situation is unique, which is why they offer personalized solutions tailored to your specific needs. Whether you're looking for a personal loan, a mortgage, or a business loan, Southland Credit has got you covered.

But don’t just take our word for it. Let’s break down some of the reasons why Southland Credit is worth considering:

- Customized loan options to suit your financial goals

- Competitive interest rates that won't break the bank

- Quick and hassle-free application processes

- Expert financial advice to guide you every step of the way

Why Choose Southland Credit Over Other Options?

When it comes to financial services, there are plenty of options out there. So, what makes Southland Credit the right choice for you? For starters, they offer a level of transparency that many other institutions lack. You won’t find any hidden fees or complicated terms and conditions. What you see is what you get, and that’s something we can all appreciate.

Another big plus is their flexibility. Whether you need a short-term loan to cover an unexpected expense or a long-term mortgage to buy your dream home, Southland Credit has options that fit your timeline. Plus, their team of experts is always available to answer your questions and provide guidance whenever you need it.

And let’s not forget about their reputation. With years of experience in the industry, Southland Credit has built a solid track record of delivering results for their clients. This level of trust and reliability is hard to come by, and it’s one of the reasons why so many people choose Southland Credit over other options.

Read also:Unveiling The Life And Legacy Of Rosemary Margaret Hobor

Southland Credit: A Brief History

To truly understand Southland Credit, it’s important to know where they came from. Founded in the heart of Southland, this company has humble beginnings but big ambitions. From its early days as a small credit provider to its current status as a major player in the financial industry, Southland Credit has always stayed true to its core values of integrity and customer satisfaction.

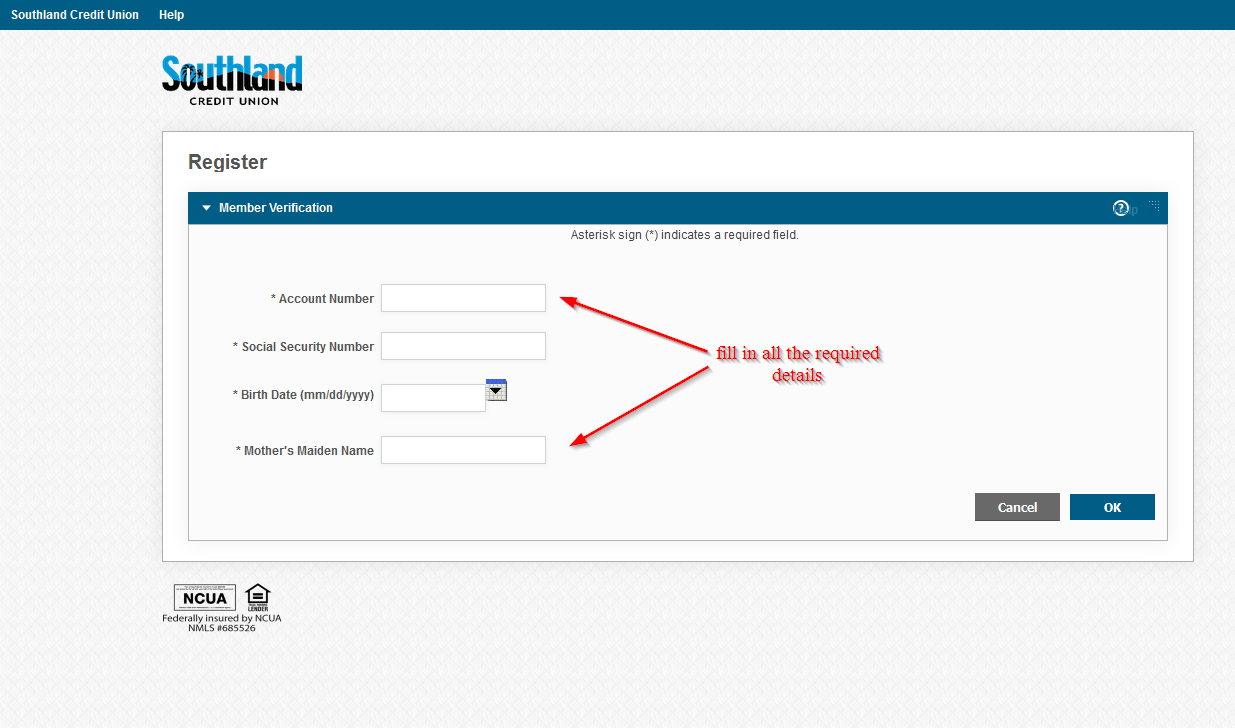

Over the years, they’ve expanded their services to include everything from personal loans to commercial financing. They’ve also invested heavily in technology, making it easier than ever for customers to apply for loans and manage their accounts online. This commitment to innovation has helped them stay ahead of the curve in a rapidly changing industry.

Southland Credit Loan Options: What’s Available?

Now that you know a bit about Southland Credit, let’s talk about what they actually offer. Their loan options are designed to cater to a wide range of needs, ensuring there’s something for everyone. Here’s a quick rundown of the most popular choices:

- Personal Loans: Perfect for covering everyday expenses or unexpected costs.

- Mortgage Loans: Ideal for buying or refinancing a home.

- Business Loans: Great for entrepreneurs looking to expand or start a new venture.

- Auto Loans: Useful for purchasing a new or used vehicle.

Each of these options comes with its own set of benefits and features, so it’s important to choose the one that best fits your situation. Southland Credit’s team of experts can help you make an informed decision based on your financial goals and circumstances.

Interest Rates and Terms: What to Expect

When it comes to loans, interest rates and terms are two of the most important factors to consider. Southland Credit understands this, which is why they strive to offer competitive rates and flexible terms. While exact numbers can vary depending on the type of loan and your credit history, you can generally expect:

- Interest rates starting as low as 5%

- Repayment terms ranging from 1 to 30 years

- No hidden fees or penalties

These numbers might sound too good to be true, but Southland Credit’s commitment to transparency means there’s no fine print to worry about. What you see is what you get, and that’s something we can all appreciate.

Southland Credit Customer Support: Always Here for You

No matter how great a financial institution’s services are, customer support can make or break the experience. That’s why Southland Credit places such a strong emphasis on providing top-notch support to their clients. Whether you have a question about your account or need help navigating the application process, their team is always ready to assist.

Southland Credit offers multiple channels for customer support, including phone, email, and live chat. They also have a comprehensive FAQ section on their website, where you can find answers to common questions. And if you prefer face-to-face interaction, they have physical branches in several locations, making it easy to meet with a representative in person.

Southland Credit Reviews: What Are Customers Saying?

One of the best ways to gauge the quality of a financial institution is to look at what their customers are saying. Southland Credit has received overwhelmingly positive reviews from clients across the board. Here are just a few highlights:

- “Southland Credit saved my life when I needed a personal loan to cover medical expenses. Their application process was so easy, and the interest rate was unbeatable.”

- “I’ve been working with Southland Credit for years, and they’ve always been there for me when I need financial advice. Their team is knowledgeable and supportive.”

- “The mortgage loan I got through Southland Credit has allowed me to buy my dream home. Their interest rates are amazing, and the entire process was seamless.”

These testimonials speak volumes about the quality of service Southland Credit provides. If you’re on the fence about working with them, rest assured that you’re in good hands.

Southland Credit and Financial Education: Empowering You to Succeed

Southland Credit believes that financial literacy is key to achieving long-term success. That’s why they offer a variety of resources to help you improve your understanding of personal finance. From blog posts and webinars to one-on-one consultations, they’re committed to educating their clients and helping them make informed decisions.

Some of the topics they cover include:

- How to build and maintain a good credit score

- Tips for managing debt effectively

- Strategies for saving and investing wisely

By equipping you with the knowledge and tools you need to succeed, Southland Credit ensures that you’re not just borrowing money – you’re building a brighter financial future.

Southland Credit’s Impact on the Community

Southland Credit isn’t just about making money; they’re also about giving back. They’re deeply involved in community initiatives and charitable programs, using their resources to make a positive impact on the world. Whether it’s supporting local businesses or donating to causes close to their heart, Southland Credit is committed to being a force for good.

This commitment to community involvement is one of the reasons why so many people choose to work with Southland Credit. It’s not just about the services they offer; it’s about the values they represent and the difference they’re making in the world.

Southland Credit: The Future of Financial Services

As we look to the future, it’s clear that Southland Credit will continue to play a major role in shaping the financial services industry. With their focus on innovation, transparency, and customer satisfaction, they’re well-positioned to meet the evolving needs of their clients.

Some of the exciting developments on the horizon include:

- Expanding their digital platform to offer even more convenient services

- Introducing new loan products to meet emerging market demands

- Continuing to invest in financial education and community initiatives

Southland Credit’s commitment to staying ahead of the curve ensures that they’ll remain a trusted partner for years to come.

How Southland Credit Can Help You Achieve Your Goals

Whether you’re looking to buy a home, start a business, or simply manage your finances more effectively, Southland Credit has the tools and expertise to help you succeed. By offering personalized solutions, competitive rates, and exceptional customer service, they’ve become a go-to choice for individuals and businesses alike.

So, if you’re ready to take control of your financial future, Southland Credit is here to help. With their guidance and support, you can turn your dreams into reality and build a brighter tomorrow.

Conclusion: Why Southland Credit Should Be Your Choice

In conclusion, Southland Credit stands out as a leader in the financial services industry, offering a wide range of products and services designed to meet the needs of their clients. From personalized loan options to expert financial advice, they’re committed to helping you achieve your financial goals.

If you’re ready to take the next step, we encourage you to reach out to Southland Credit and see how they can assist you. Whether you have questions about their services or want to apply for a loan, their team is ready to help. And don’t forget to share this article with others who might benefit from the information – together, we can all build a brighter financial future.

Table of Contents

- What Is Southland Credit All About?

- Why Choose Southland Credit Over Other Options?

- Southland Credit: A Brief History

- Southland Credit Loan Options: What’s Available?

- Interest Rates and Terms: What to Expect

- Southland Credit Customer Support: Always Here for You

- Southland Credit Reviews: What Are Customers Saying?

- Southland Credit and Financial Education: Empowering You to Succeed

- Southland Credit’s Impact on the Community

- Southland Credit: The Future of Financial Services